georgia property tax relief

Almost all 93 percent of Georgias counties and over 140 of the cities have adopted a Level One Freeport Exemption set at 20 40 60 80 or 100 percent of the inventory value. The maximum exemption is currently 85645 and this figure is revised every year.

Inventory Tax Exemption Georgia Department Of Economic Development

Property tax returns must be filed with the county tax office between January 1 and April 1 of each year.

. Get Rid of Outbuildings. To obtain verification letters of disability compensation from the Department of Veterans. The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases.

Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. Property Tax Millage Rates. For more information about the COVID-19 virus please visit.

Property Tax Returns and Payment. There are age income and residency restrictions that must be met to qualify. House Bill 451 was signed into law by Georgia Governor Brian Kemp on May 4th 2021.

There are also a number of property tax exemptions in Georgia that can reduce your homes assessed value and therefore your taxes. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. 48-5-482 C 2 can elect to claim the amount of finished goods inventory to be.

Every state has its own rules to meet its local needs. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes value may be exempt from the. Information about actions being taken by the US.

Georgia manufacturers can receive temporary property tax relief for property tax year 2021 with the passage of HB 451 which expands the states Level 1 Freeport Inventory Exemption. The Freeport exemption offered by several of the states local governments allows Georgia manufacturers to exempt finished goods surplus inventory. Review Your Property Tax Card for Errors.

Manufacturers that claim the Freeport Exemption OCGA. Property Tax Proposed and Adopted Rules. Surviving Spouse of Peace Officer or Firefighter.

Every Georgia resident whose home is owner-occupied as a primary residence may receive 2000 as a tax exemption from county and school taxes. Georgia Property Tax Rates. Age 62 or older.

The homestead exemption is standard and is calculated by deducting the 2000 from 40 percent of the assessed property value. Property tax relief for seniors and people with disabilities. Line of Duty Exemption.

Real Property Tax Law 425 McKinney. Individuals 65 years or older may claim a 4000 exemption from all state and county ad valorem taxes if the income of that person and hisher spouse did not exceed 10000 in the previous year excluding income from retirement sources pensions and disability income up to the maximum allowable amount under the Social Security Act which was 55742 in 2011. Coronavirus Tax Relief Information.

Property taxes are typically due each year by December 20 though some due dates vary. The statewide exemption is 2000 but it applies only to the statewide property tax which is a relatively small slice of the overall property taxes in most areas. You should check with your county tax office for verification.

The H-2 property tax exemption if you qualify will offer a full exemption from state property taxes and reduce a propertys value by 5000 on all property and school districts. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. GDVS personnel will assist veterans in obtaining the necessary documentation for filing.

Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases. Centers for Disease Control and Prevention CDC for health information. Move to a Less Expensive Area.

A reduction of 60000 on the assessed value of your home 40 of its market value in most counties An additional sum determined by the county of residence and dependent on your disability grade and circumstances. County Property Tax Facts. The actual filing of documents is the veterans responsibility.

Co-located data centers and single-user data centers that invest 100 million to 250 million in a new facility may qualify for a full sales and use tax exemption on eligible expenses which. In some counties property tax returns are filed with the county tax commissioner and in other counties returns are filed with the county board of tax assessors. Georgia offers a school property tax exemption for homeowners age 62 or older whose household income is 10000 or less excluding certain retirement income.

Check to See If You Qualify for Property Tax Relief. The law provides property tax relief to taxpayers that have had slow-moving inventory as a result of the COVID-19 pandemic. Have Your Property Independently Appraised.

How long is the extension to pay and file. 10 Ways to Lower Your Property Taxes Lower Your Tax Bills. Appeal Your Tax ValuationPromptly.

Georgia income tax payments and GA income tax returns due on or after April 15 2020 and before July 15 2020. Business inventory is exempt from state property taxes as of January 1 2016. Property Tax Homestead Exemptions.

This 192-page book is a review of all the ad valorem tax incentives offered by the State of Georgia to Georgia Landowners including Agricultural Preferential Conservation Use Valuation CUVA Timber Tax calculations and payments the Forest Land Protection Act FLPA and the new Qualified Timber Property QTP tax class. Before sharing sensitive or personal information make sure youre on an official state website. If a member of the armed forces dies on duty their spouse can be granted a property tax exemption of 60000 as long as they dont remarry.

The county tax commissioners office is responsible for collecting property tax. For qualifying seniors it exempts the first 62200 of the full value of the home from school taxes NY. Local state and federal government websites often end in gov.

New signed into law May 2018. These vary by county. A Level One Freeport Exemption may exempt the following types of tangible personal.

Alaska Disabled veterans in Alaska may receive property tax exemptions up to the first 150000 of the assessed value of hisher primary residence if the veteran is 50 percent or more disabled. May 11 2021. Most states offer the ability for seniors and disabled people to receive a reduction in their property taxes.

Compare Tax Cards of Similar Homes. Property taxes are paid annually in the county where the property is located. A spouse of a firefighter or a peace officer who has died on duty has the right to get a property tax exemption as long as they still live in the house.

Georgia Tax Relief Information Larson Tax Relief

Property Overview Cobb Tax Cobb County Tax Commissioner

Exemptions To Property Taxes Pickens County Georgia Government

Forsyth County Government News Homestead Age 65 Tax Exemptions Can Now Be Filed Online

What Is A Homestead Exemption And How Does It Work Lendingtree

Houston County Assessor S Office

Board Of Assessors Homestead Exemption Electronic Filings

Learn More About Georgia Property Tax H R Block

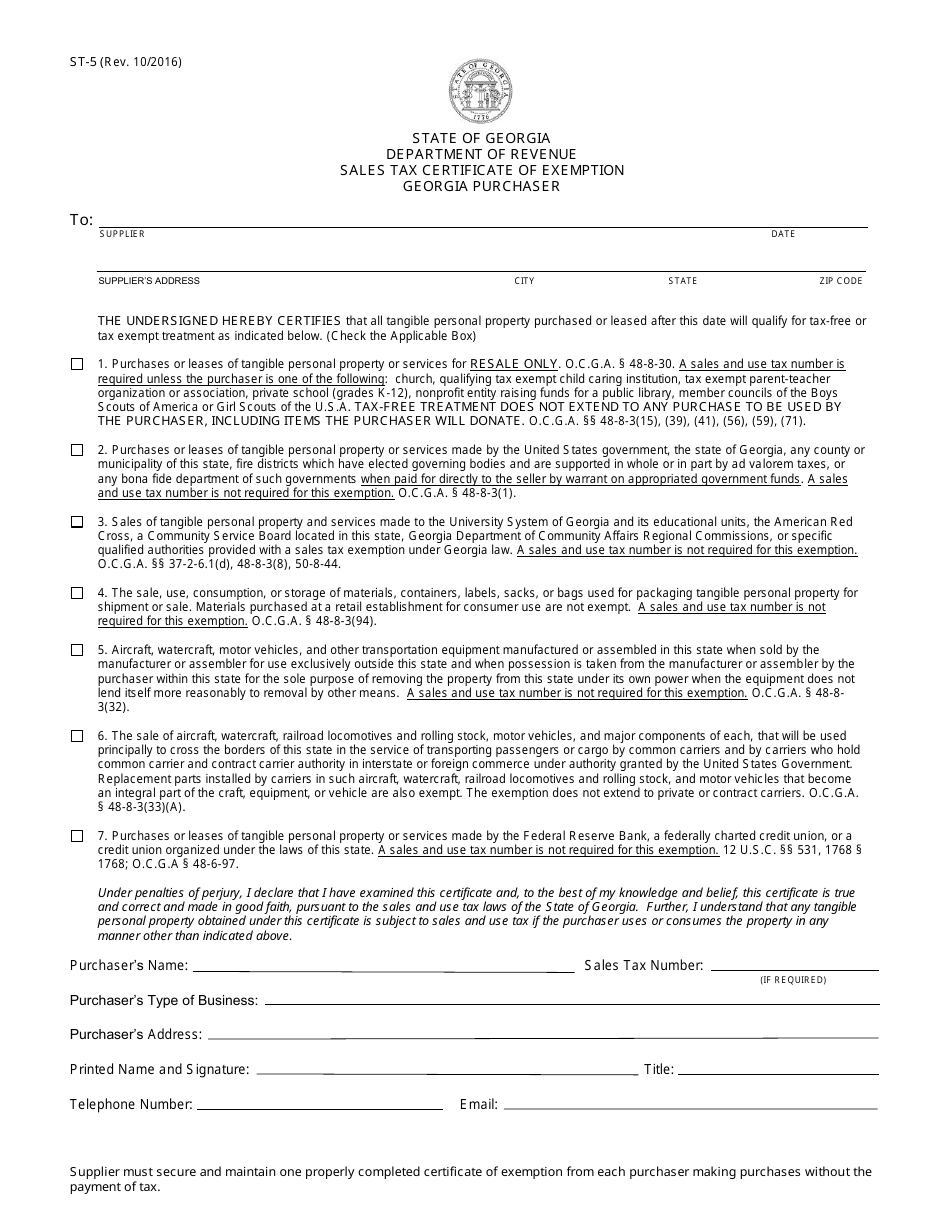

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Property Tax Homestead Exemptions Itep

Georgia Estate Tax Everything You Need To Know Smartasset

Exemptions To Property Taxes Pickens County Georgia Government